Build The Safety Net Every Family Needs

Unexpected events happen. Your plan should be simple.

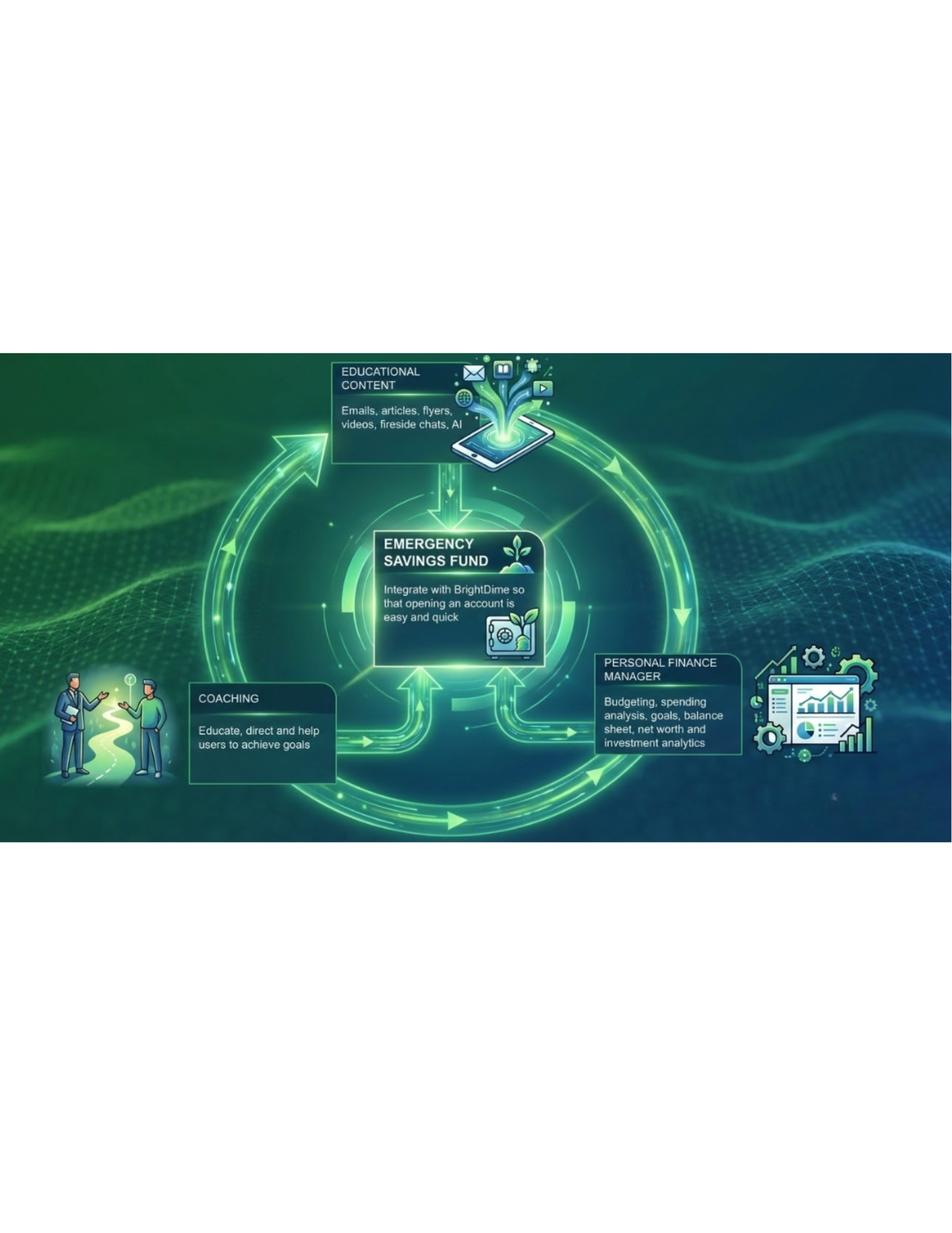

Our coaches help you with emergency savings account setup and personalized financial coaching to build a reliable emergency fund.

Set Up a Clear, Achievable Emergency Fund Target

Learn About Automated Savings Options

Account Setup Guidance

Gain Peace of Mind for Life's Surprises

Frequently Asked Questions

Here you can find some of the most common questions we receive.

-

What is an emergency fund and why is it important?

An emergency fund is money set aside to cover unexpected expenses like car repairs, medical bills, or sudden income loss. Building an emergency savings buffer helps reduce financial stress, prevent debt, and keep you on track with your long-term financial goals.

-

How much should I save for emergencies?

Most financial experts recommend saving three to six months of essential expenses, but the right amount depends on your income, family size, and job stability. BrightDime’s coaches can help you calculate a personalized target that fits your situation.

-

How do I start building an emergency savings fund?

Start small and build consistently. Setting up automatic transfers, rounding up purchases, or saving a portion of each paycheck makes saving easier. BrightDime’s tools and coaching provide step-by-step guidance to help you create a realistic emergency savings plan.

-

What if I can’t afford to save right now?

Even small steps matter. BrightDime can help you identify areas to cut back, reduce financial stress, and find creative ways to start building a cushion, even if money is tight.

-

How does BrightDime support long-term financial security?

Beyond emergency savings, BrightDime provides personalized coaching, financial education, budgeting tools, credit support, and goal setting to help you build financial confidence and reduce money stress over time.

Get started today!

It only takes a few moments to signup.